I've been finding out that when I do my daily activities and come home around 2:00 during the afternoon, I haven't been glued to my screen all day searching for trading opportunities and I don't really have a bias to to whether the market is going up or down. This past week I've made some very profitable trades coming in late and reading my charts and volume trends. I always notice there is a sell off before lunch usually because traders don't want open positions while they are stuffing their face with caviar and champagne. After the noon swoon, as Dr. J, from OptionMonster.com calls it buyers usually kick in and buy into the mid or late day session (usually, not counting every day).

There are great trading opportunities when you see a stock testing it's day high on good volume, and keeping up near the top. All you have to do is watch the major indexes and if they follow suit and break higher then your stock should immediately take off, no hesitations, because that means buyers aren't prevalent and sellers could take over considering it's at the day high, and all your longs are now green.

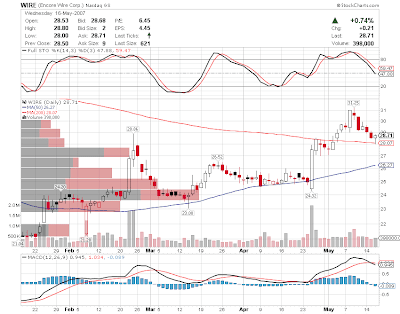

Todays trade:

I grossed $363 on the trade scaling in on 800 shares and scaling out for a quick trade. Remember watch that volume, it is key!!!