When I first started trading I thought, "Man, I'll make thousands each day, and be able to buy anything I want." Well, the first month of trading I found that not to be true, and I've realized every trade is a fight. People ask me all the time, "Well where does all that money go when you lose it? And that proposes a good question, but the answer is in someone else's pocket, because for every buyer there is a seller, so when you're in the red, Billy Bob is sitting in the green. You must learn to protect capital in order to advance to a higher level of trading, only then will you remain consistently profitable, given that you're trading nice setups poised to breakout in the first place. BTW, what is a

Breakout?

Yesterday I found a nice little company called Ingen Technologies, it develops and markets cutting-edge medical technologies designed to increase accuracy of medical care and prevent unnecessary medical costs.

They released a new medical device

OxyView(tm) which helps your respiratory system maintain good oxygen levels in asthma patients.

This stock is treading HIGH

RSI levels (

90), high volume, and crossing above (

200) MDA, and is up

350% in the past 3 days.

Thanks to good research and quick execution I was able to capture:

Entry: $0.096

Current: $0.17

Gain:

77%

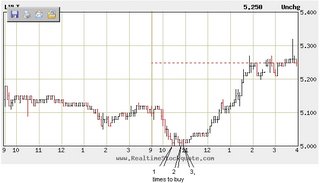

Update: Apple (

AAPL) is up

3%, after bottoming on yesterday's purchase price of $72.99-$73.10 a share. Nice bottom pick.

Update: I will be holding my Level 3 Comm. (

LVLT) shares until earnings. Entry price was at $4.88