Today I surfed some good trades in oil. I usually watch oil prices on CNBC flip back and forth, but that became annoying.

My remedy: Chicago Mercantile Exchange Real Time Crude Oil Quote.

Today's trades included: Peabody Energy Corp. (BTU), Transocean Inc. (RIG), Joy Global Inc. (JOYG), and Level 3 Communications, Inc. (LVLT).

Nothing spectacular, just quick scalps really.

Trades: 12

Shares: 50,000

Gross Profit: $698.30

Today was probably the easiest money I've made, I mean I studied my setups, drew trendlines, watched the MACD for signals on a 30 minute chart, for an 8-day period. The signals are clear as day! I'll show one example. I spent around 2 or so hours at the computer. I went to my college courses, came back, put in my orders, and stops, took a shower, ate lunch, watched the daily market news and as you can see it performed nicely for me.

Peabody Energy Corp. (BTU)

Now after the MACD (Moving Average Convergence Divergence) signaled my buy, I scalped for $0.20 cents, 2 times, on 1000, and 1,400 share lots. As you can see from the chart the MACD never crossed back over signaling a sell point. I however did not want to participate in the volatile fluctuations of the Crude Oil Market today, so I played it safe.

Now for some good Ideas on Swing Plays that could possibly profit nicely.

Best Buy Co., Inc. (BBY) (Possibly a Near-Term Buy)

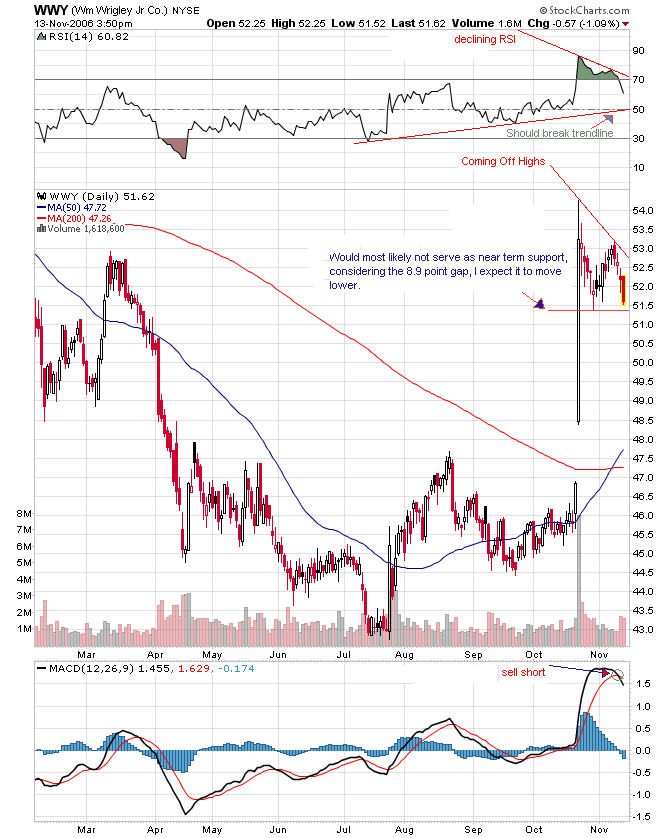

Wm. Wrigley Jr. Company (WWY) (Possible short canidate)

Disclaimer: I am not a CFA, or stock broker and take no responsibility in the choices you make from the recommendations from this website. Use information accordingly under preferable market conditions to avoid substantial losses.

No comments:

Post a Comment